How to Make the Most of CFD Trading: Expert Tips and Strategies

How to Make the Most of CFD Trading: Expert Tips and Strategies

Blog Article

The Basics of CFD Trading: How It Works and What You Should Know

Agreement for Difference (CFD) trading offers investors a unique method to business economic markets without buying the main asset. It's gained recognition for its mobility and prospect of large results, but like any trading technique, it takes skill and understanding to succeed. Whether you're a starter or looking to refine your strategy, here are some specialist methods and methods to assist you make the most of cfds.

1. Realize the Fundamentals of CFD Trading

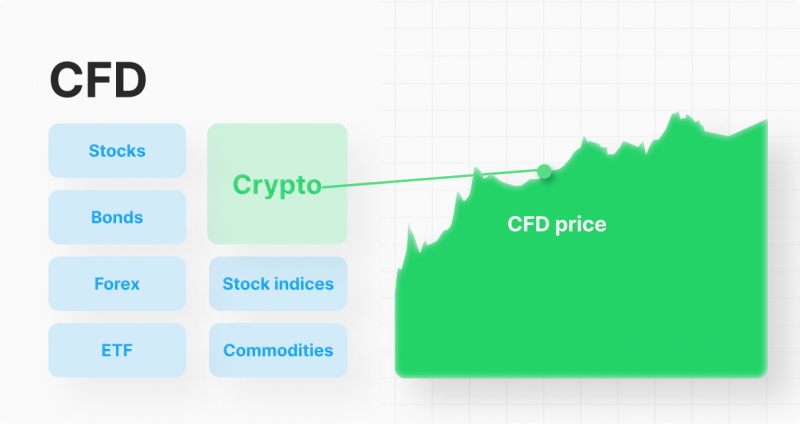

CFD trading lets you speculate on the cost action of resources such as for example shares, commodities, forex, and indices. When you enter a CFD business, you are accepting to exchange the big difference in the price tag on an asset between the time you open and shut the contract. This means you are able to profit from equally rising and slipping markets.

Before moving in, it's essential to have a stable knowledge of how CFDs work, along with the associated risks. Take some time to familiarize yourself with critical phrases and methods such as for example distribute, margin, and contract dimensions to help with making informed trading decisions.

2. Utilize Variable Power Wisely

One of the very fascinating top features of CFD trading is variable leverage, allowing traders to regulate bigger jobs with an inferior money outlay. Nevertheless, while power can improve profits, additionally it magnifies potential losses. Use control cautiously and ensure you are confident with the degree of chance it introduces into your trading.

3. Create a Chance Management Technique

A great chance management strategy is crucial in CFD trading. Always set stop-loss orders to limit possible deficits and protect your capital. Also, define the quantity of money you're willing to risk per trade and stay glued to it. Never risk more than you are able to afford to lose, as trading inherently carries some amount of risk.

4. Keep Updated with Industry Media

CFD costs are very inspired by industry news and global events. Remaining updated on financial reports, geopolitical developments, and market emotion can assist you to anticipate cost movements. Use trusted news options and consider incorporating basic analysis into your trading strategy to produce better-informed decisions.

5. Choose the Right Areas to Business

CFD trading offers a wide variety of markets to deal, but not absolutely all markets might suit your trading style. Some markets tend to be more unpredictable, offering higher potential gains but additionally better risks. Others are far more secure, which can match risk-averse traders. Assess industry problems and select those that align with your risk patience and strategy.

Conclusion

CFD trading can be a rewarding experience when approached with knowledge and strategy. By understanding the basic principles, using leverage responsibly, handling risk, and staying educated, you can increase your likelihood of success. Recall, trading is a ability that improves as time passes and experience, therefore show patience and carry on understanding as you go. Report this page